Dec 6, 2024 • 7 min read

Your Essential Guide to Navigating CTP Claims

Written by: Devanshi Sarda

Did you know that Compulsory Third Party insurance claims, or CTP claims, can involve a rehabilitation provider like AusRehab for improved recovery outcomes?

In this article, we cover key things to understand about CTP insurance, including a step-by-step breakdown of the claims process, as well as how we can step in to better facilitate your recovery journey.

What is Compulsory Third Party (CTP) Insurance?

Also known as a Green Slip in NSW, CTP insurance is not only mandatory, it is also required before vehicle registration can take place. It is designed to provide financial and medical support to anyone affected in a motor vehicle accident.

What Does a Green Slip Cover?

- Medical & treatment expenses

- Income support payments

- Care & support services (domestic assistance & specialised care services)

- Compensation for pain & suffering (lump sum payments)

- Funeral costs

Who Is Covered Under a Green Slip?

- The driver of the vehicle

- Passengers

- Pedestrians

- Cyclists

- Motorcyclists

Note: CTP insurance is not the same as standard car insurance. While CTP covers personal injuries and fatalities resulting from motor vehicle accidents, car insurance (such as comprehensive or third-party property insurance) is designed to cover damage to vehicles, property, and sometimes theft or fire.

What Does CTP Insurance Cover in NSW?

- Liability Coverage:

- Covers your liability for injuries caused to third parties in a motor vehicle accident.

- Covers the liability of others driving your vehicle for injuries caused to third parties.

- Medical Treatment and Expenses:

- Up to 12 months of treatment and rehabilitation costs.

- Includes commercial attendant care if help at home is needed during recovery.

- Lost Income:

- Covers a percentage of pre-injury weekly income if you need time off work to recover.

- Extended Benefits for Not-At-Fault and Severe Injuries:

- If you are not primarily at fault and have more than a minor injury, you may be eligible for benefits that extend beyond 12 months.

What Is Not Covered In CTP Insurance?

- Damage to Vehicle:

- CTP does not cover damage to your vehicle or other people’s vehicles in an accident as it’s a form of personal injury compensation.

- For vehicle damage claims, you’ll need comprehensive or third-party car insurance.

- Damage to Property:

- CTP does not cover damage to other types of property, such as buildings or infrastructure impacted in a motor vehicle accident.

How Does CTP Insurance Differ From Workers Compensation?

Who Is Eligible To Claim Through CTP?

Anyone injured in a motor vehicle accident in NSW – including drivers, passengers, motorcyclists, pillion passengers, pedestrians, and cyclists – may be eligible to claim through CTP insurance, provided the accident occurred on or after 1 December 2017.

The extent of benefits depends on fault status, injury severity, and whether the injuries are classified as threshold or non-threshold.

What Determines Whether My Injury Is Threshold or Non-Threshold?

Threshold Injuries

- Expected to heal over time with minimal medical intervention

- Common types of threshold injuries include:

- Soft Tissue Injuries:

- Strain to muscles

- Tendons

- Ligaments

- Threshold Psychological Injuries:

- Mild psychological responses

- Adjustment disorders

- Acute stress reactions

- Soft Tissue Injuries:

Non-Threshold Injuries

- Covers more severe injuries that don’t fall under the criteria for soft tissue or minor psychological injuries, and often require extended or intensive treatments

- Common types of non-threshold injuries include:

- Serious Physical Injuries:

- Fractures

- Nerve damage

- Complete or partial tears of tendons, cartilage, meniscus or ligaments

- Severe Psychological Injuries:

- Depression

- Post-Traumatic Stress Disorder (PTSD)

- Serious Physical Injuries:

What Are The Differences In Claimable Benefits Through CTP?

After 1 December 2017

Before 1st December 2017

If the person was not at fault, they can make a claim for a range of benefits including past and future medical treatment and rehabilitation costs, care costs and economic losses, as well as payments for pain and suffering (in some circumstances).

If the person was at fault, the Green Slip may provide limited cover, up to the first $5,000 of treatment costs and lost income incurred in the first six months after an accident.

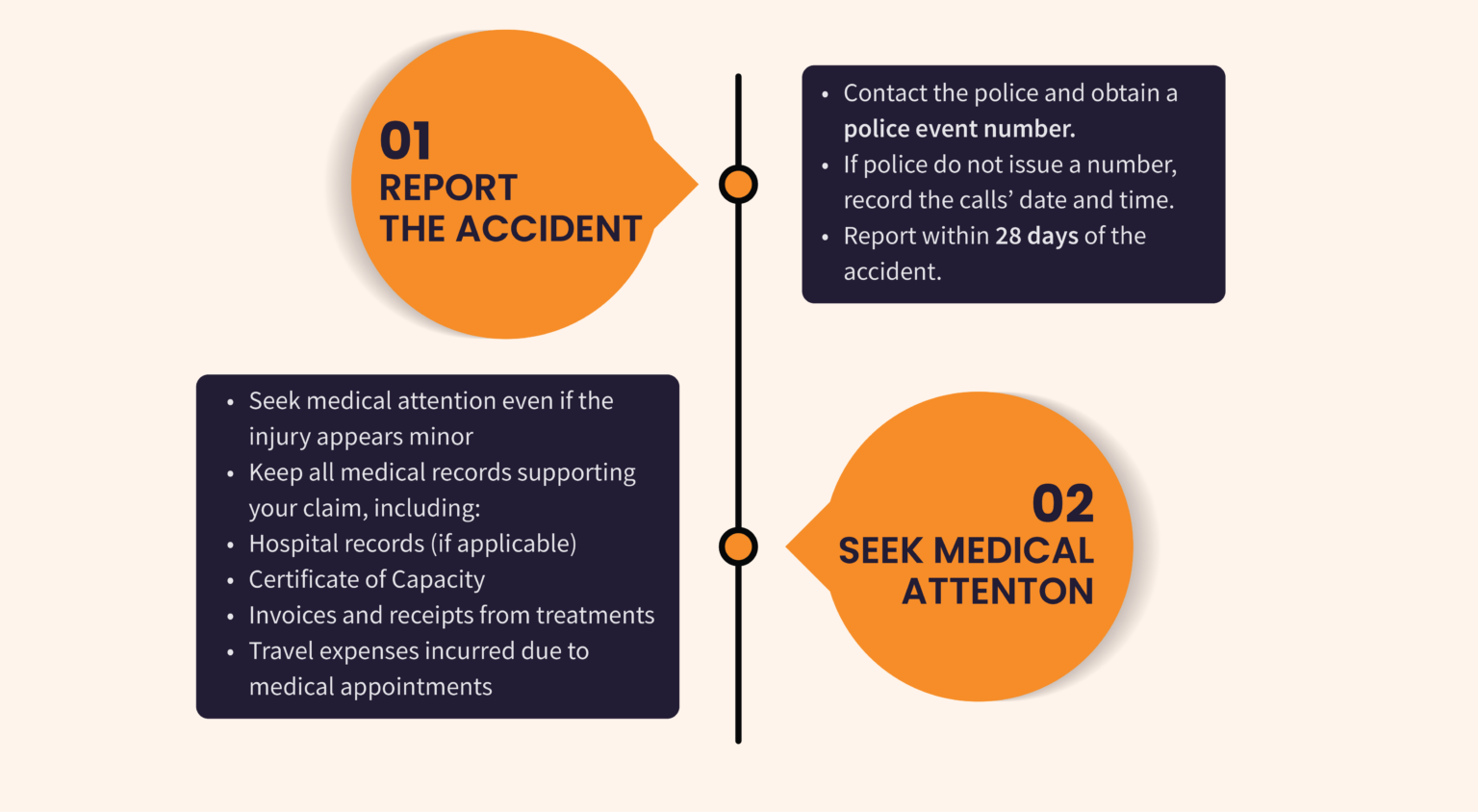

How To Lodge a CTP Claim

To ensure a successful CTP claim, be mindful of the submission deadlines as:

- Lodging a claim within 28 days of the accident allows eligibility for back payments.

- Claims submitted up to 3 months post-accident are still accepted, though they may not qualify for back pay.

- Claims beyond the 3 month window require a full and satisfactory explanation to justify the delay.

When We Step In

- If the injured person’s recovery is complex or requires specialised rehabilitation (e.g. physical therapy, psychological support, or functional assessments)

Our Role as a Rehab Provider

- Assist in creating tailored rehabilitation plan

- Collaborate with treating doctors to determine the appropriate treatment, therapies, or support services

When We Step In

- If medical records and reports need detailed insights into functional capacity, treatment plans, or progress updates for the claim

Our Role as a Rehab Provider

- Provide functional capacity assessments or progress reports for submission to the insurer

- Identify ongoing rehabilitation needs that should be covered under the claim (e.g. physiotherapy, psychological care, or assistive devices)

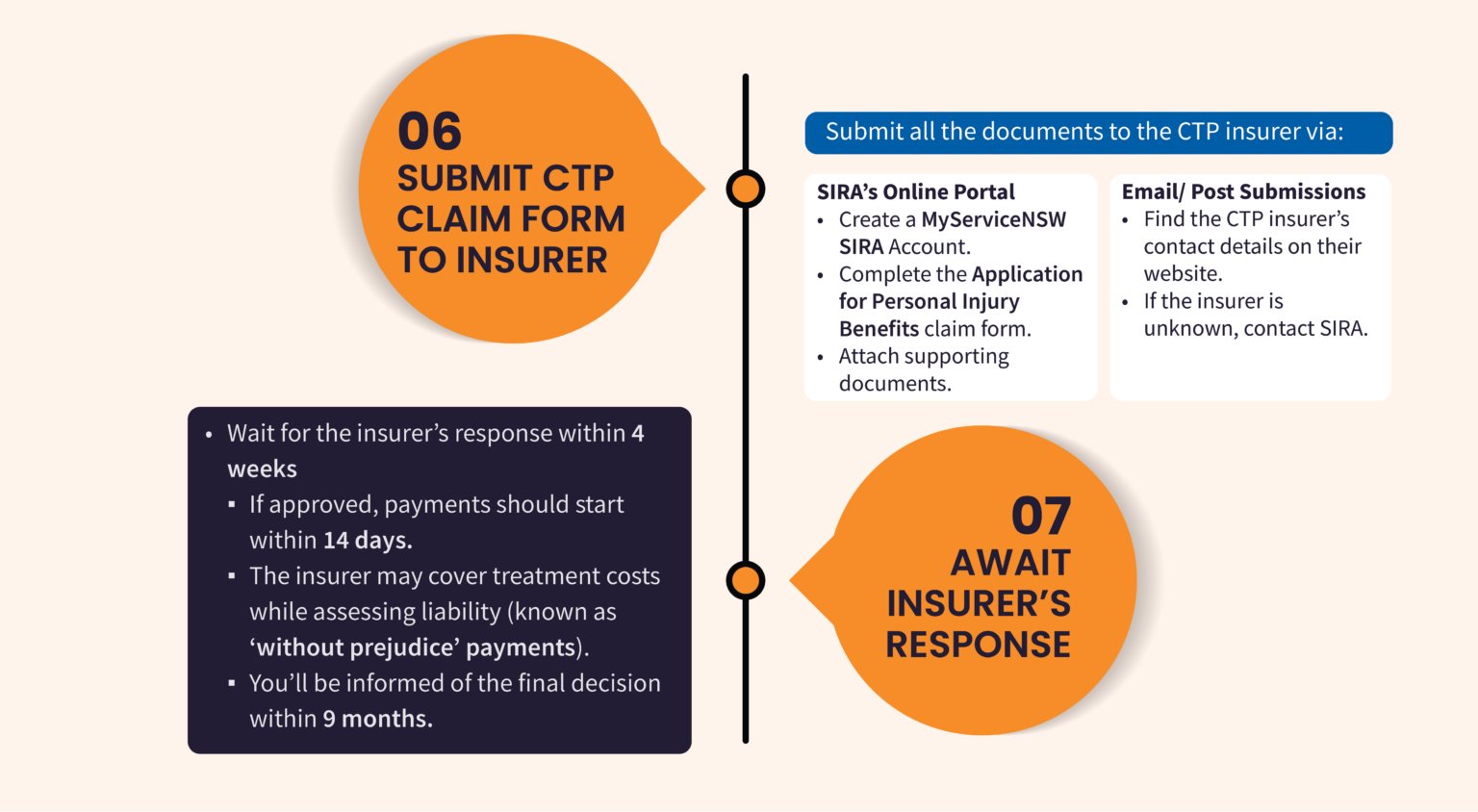

When We Step In

- Stage 6: If the claim involves rehabilitation services or the insurer requires a clear outline of ongoing care needs

- Stage 7: After the insurer approves the claim and allocates funding for rehabilitation

Our Role as a Rehab Provider

- Stage 6: Work with the claimant and their legal/claims support to document specific rehabilitation services required

- Stage 7: Implement the rehabilitation plan, including:

- Coordinating therapies (physical, occupational, psychological)

- Arranging aids and equipment (e.g. wheelchairs, home modifications)

- Monitoring progress and adjusting plans as needed

How AusRehab Can Support Your CTP Journey

Navigating a CTP claim can be complex, and our team of experts are AusRehab is here to simplify the process and guide you through every step. Whether you’re seeking guidance on eligibility, documentation, or compensation options, we’re committed to supporting your recovery and securing the benefits you deserve.

Let AusRehab be your trusted partner on the path to your motor vehicle accident recovery. Contact us today to get started!

For more resources and support on CTP, see:

- CTP Connect

- Application for Personal Injury Benefits

- Application for Damages Under Common Law

- Certificate of Capacity

- MyServiceNSW SIRA Account

- SIRA Contact Details

- Email: ctpassist@sira.nsw.gov.au

- Phone: 1300 656 919

Want to Make a Change? Share with Anyone, Anywhere.

Don’t forget to share!

Devanshi creates insightful content that highlights best practices in injury management, ergonomic solutions, and strategies to foster safer work environments. Devanshi’s writing aims to inform and support businesses and workers in implementing effective workplace safety measures and rehabilitation practices.

Subscribe to stay updated on the latest workplace news.

Resolve your work

place injury today